Smarter, safer business payments with virtual cards

Make spending streamlined, secure, and efficient from end to end.

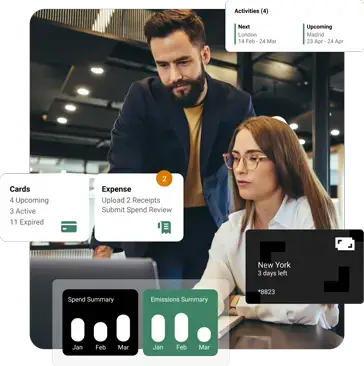

Simple business spending

Corporate payments are stress-free and secure with virtual cards.

Corporate travel

Isn’t it time your payments did more? Say goodbye to messy manual processes and take control of your spending with virtual cards.

Hotels

Offer the best for your guests with smooth payment experiences that keep corporate customers coming back time and time again.

Travel management companies

Travel is tricky enough, make payments painless for your clients with secure virtual payments that keep spending simple.

Fuss-free and frictionless

Thousands of businesses are making the switch to smarter, safer payments with virtual cards. What are you waiting for?

Total security, complete control

Keep a close eye on costs with virtual cards. Set spending limits, edit expiry dates, and capture custom data for a solution that locks down spend and minimises misuse.

Goodbye admin, hello automation

Ditch the headache of manual processes and focus on the things you do best. Expense reports? Long gone. Reconciliation? Automated. Invoice chasing? Leave it to us.

See how we’ve helped businesses like yours

View all case studiesAmerican Express Global Business Travel

AMEX GBT - End to end automated data enrichment and invoicing with Conferma snap+.

Read case studyHSBC

Simplifying supplier payments by implementing virtual card number technology powered by Conferma.

Read case study

Book a smarter payment technology demo

Book a demo with Conferma and discover how our payment technology can revolutionise your business.

Smart, secure, simple

We power your business with easy virtual payments. We partner with top brands and financial leaders - to deliver smarter, safer, and more efficient processes.

-

0+

Card issuers

-

0k

Cards issued per week

-

0%

Customer retention

-

0+

Customer countries